Feature overview: Tax calculations in HostBill

Don’t let complicated tax calculations be the hassle of your billing. HostBill offers a wide range of tax options so you can configure the tax by yourself or use one of our pre-set tax settings.

No more sweating over manual calculations of relevant taxes! To address multiple tax calculation issues, HostBill is capable of defining complex tax structures and adding additional taxes which are calculated over other tax amount.

Tax configuration

With HostBill you can set multiple tax rules and levels to comply with all applicable legal requirements. Once you enable taxes in HostBill (in General Settings) you can easily configure your tax rates and options.

You can choose if the tax should be inclusive, where the prices displayed in the system are gross prices (net values and included tax will be automatically calculated), or exclusive, with the prices that you set in the system are net prices (customer will see on the invoice net price + tax calculated from this price).

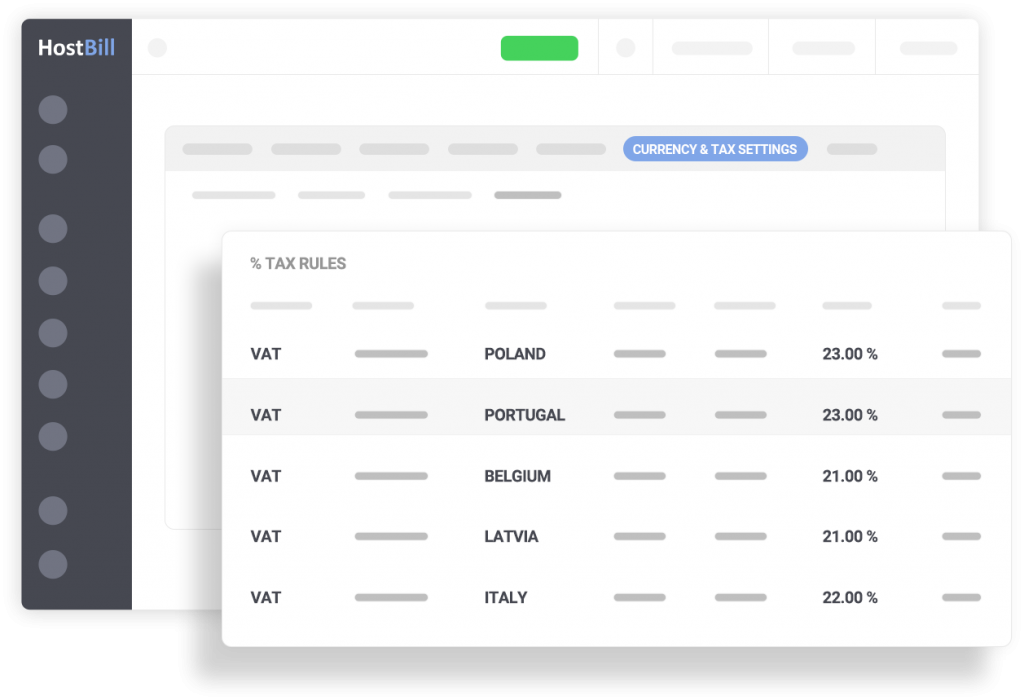

Taxes can be added manually, or you can save time and hassle and quickly set-up your tax configuration by using one of our presets. Simply choose a country from the drop-down list and apply all the taxes with a single click of the mouse!

If you however decide to set up your taxes by hand, simply add the tax name displayed in the client area, select between 1 and 2 tax level, enter a percentage tax rate, choose the country (you can apply the tax to all your customers or only those from the selected country) or optimally even the state. You can also assign tax to a certain tax group.

Tax per product

In HostBill, you can also set the tax rate per item, regardless of the localization. This gives you plenty of new opportunities, especially when you have multiple products and services in your portfolio that need to have different tax rates applied, as it may be the case in some of the European Union countries. You can also create multiple tax groups with different tax levels and assign them to different products. Once you create a group you can add and configure a new tax and assign it to the given group.

Advanced tax options

Advanced tax features allow you to add additional taxes for late invoices (applying taxes to the late fee balance), calculate negative tax (for items with negative amount on all invoices or on credit note invoices), control whether tax should be calculated before or after credit is applied. You can decide whether or not to tax time tracking entries (used for billing tickets) and if HostBill should add tax to invoices generated with the “Add funds” feature. You can also choose to round tax: either for each item / invoice line or round tax for total amount.

Setting taxes for European Business

If you’re running an EU-registered business there are some strict tax rules to follow. HostBill gives you the tool to make the EU tax configuration quick and simple. The fastest way to add all rules for your country and other EU-Member countries is to use the premade tax list, where all taxes are already configured. You also need to collect VAT ID numbers. To help you with that in Registration Fields you can select the “European Business” profile in the Premade field profile. This will automatically add VAT-EU field. You can also manually add VAT-EU to your registration fields, just make sure that this field applies to the Company and set the variable name in Advanced tab to vateu.

It is important to verify client VAT ID against EU VIES system. You can do that with our VIES VAT plugin that automatically enables tax exemption for verified EU businesses and sets local tax rate for non-business customers.

Speed up your billing process and use HostBill to calculate the appropriate tax and add it to your invoice!

You can read more about Tax settings in HostBill in our documentation.