EU Billing features in HostBill

Invoicing requirements and common billing practices are different in Europe and USA or other countries. HostBill invoicing system offers a range of sophisticated options that will help you to comply with all requirements and automated tax calculations to help you run your billing operations with ease.

The main difference between invoicing in European Union is using pro-forma invoicing. Pro-forma invoice is a preliminary draft of an invoice sent to buyers in advance of a shipment or delivery of goods or services. Typically, it gives a description of the items concerned and notes the amounts to be invoiced along with other related details. For some parties, it is used as a quotation or estimate. The final invoice is generated only when the payment is received.

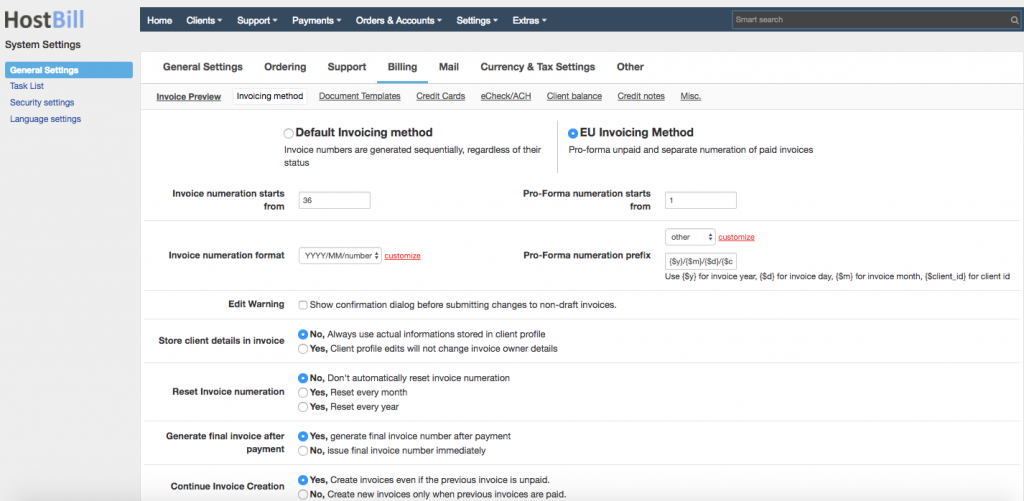

In HostBill you can easily switch between Default invoicing method and EU invoicing method. If you choose the EU invoicing method you will have additional billing configuration options available.

Invoice numeration

In Default Invoicing method the invoice numbers are generated sequentially, regardless of their status while in EU Invoicing method the pro-forma invoices and paid invoices have separate numeration. You can set the invoice numeration and prefixes and you can also choose whether or not to reset invoicing numeration, and if yes when (each month or year).

Generating Final Invoice

In HostBill you can choose if you want to generate final invoice number immediately or to wait after the payment is received. If you choose to generate the invoice immediately, the invoice ID will be assigned regardless of the payment status or payment date. By default pro-forma invoice is updated to final invoice right after payment. However, you can enable “Final Invoice Delay” feature and as a result automation will wait certain number of days before updating invoices to final.

PDF Invoices

HostBill automatically generates and sends out the pro-forma invoices to your customers. You can choose if you want the pro-forma invoices to be sent in a text-only format or as a PDF attached to the email notification. The PDF invoice generated by HostBill can be either a one-page original invoice document, or consist of an original and copy of the invoice in one document (copy as a second page). You can also choose to store all the PDF invoices on your server (for later use for download). Optionally you can choose not to generate PDF invoices automatically but only on request.

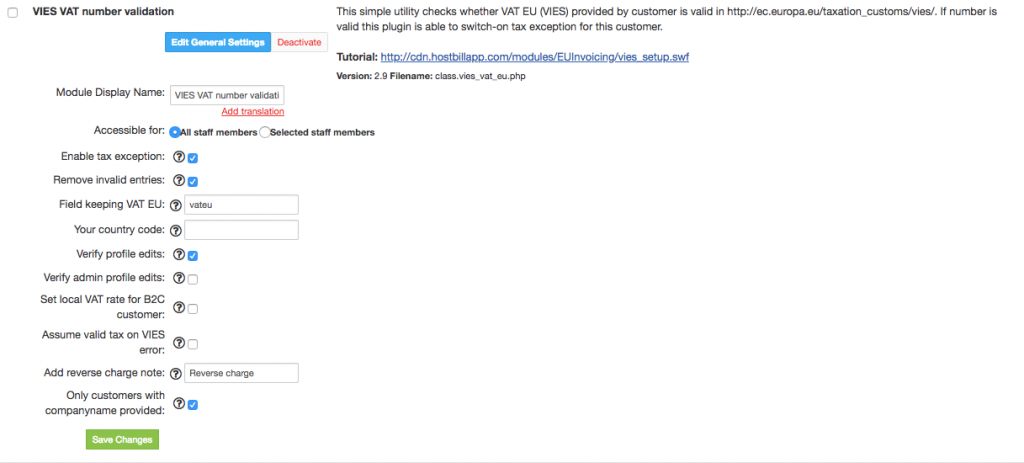

VAT

Another important requirement concerns VAT numbers and rates, as all invoices in EU should contain: customer’s VAT identification number (if the customer is liable for the tax on the transaction), VAT rate applied, VAT amount payable and breakdown of VAT amount payable by VAT rate or exemption. How to handle all of this? Simple! Use our VIES VAT EU plugin – it’s a must-have for every EU business! This extremely helpful tool will allow you to check whether VAT number provided by the customer is valid based on European Commission tool: VIES (VAT Information Exchange System). If the number is valid the plugin can automatically switch-on tax exemption for the customer and apply reverse-charge note to related invoices. Invalid VAT-id entries will be automatically removed and all VAT field or tax-exempt changes will be logged, enabling you to prevent customers from your country from getting tax-exemption. Thanks to this module you can also auto-set local tax rate for B2C customers.